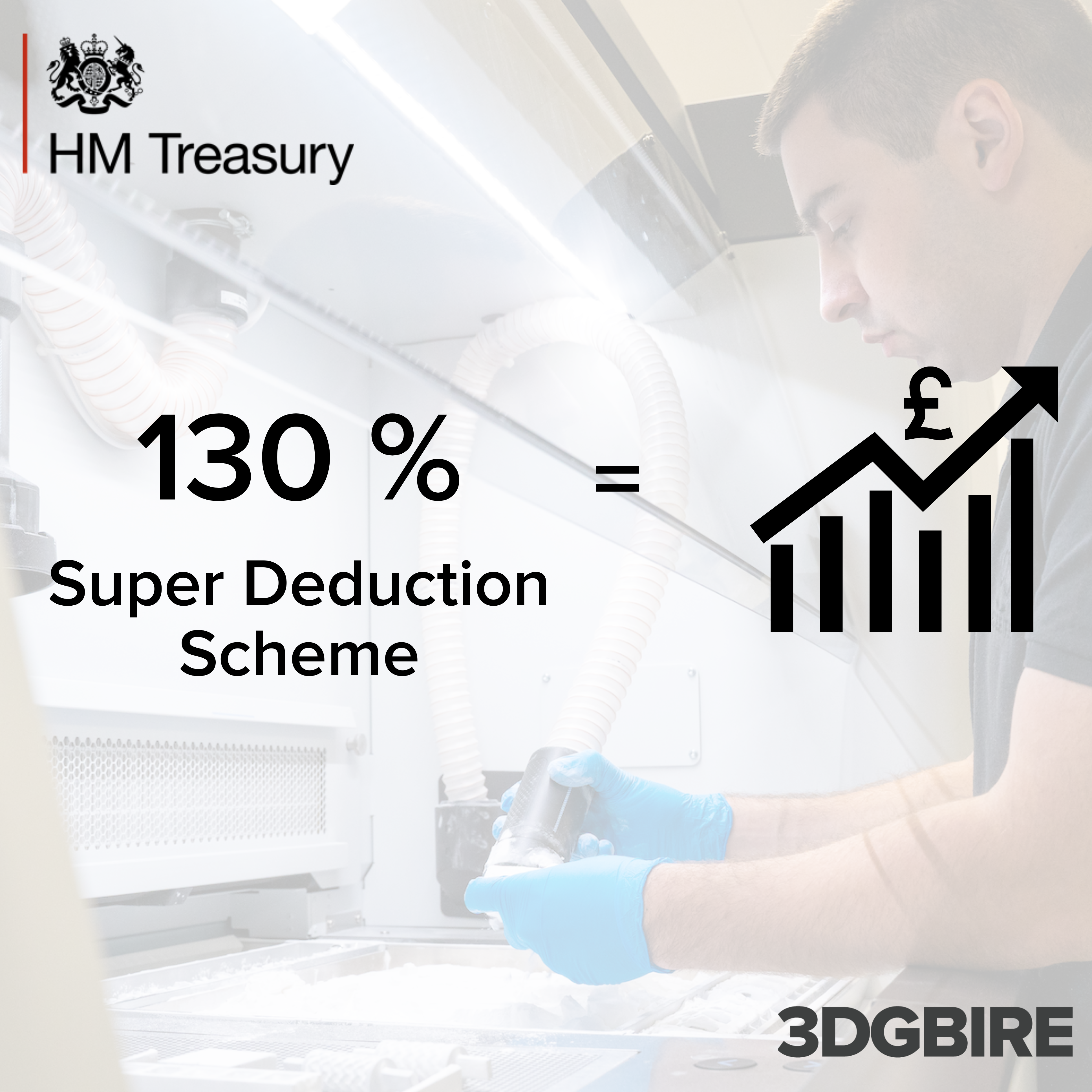

Super Deduction Scheme

The End of Super Deduction is Imminent

Now is the best time to invest in Additive Manufacturing Equipment, due to the introduction of a Super Deduction Scheme by the UK Government.

With the super deduction period drawing to a close, Companies who pay Corporation Tax can purchase 3D printers and use 130% of the value of the printer against Future Corporation Tax Liability*.

The 130% capital allowances super-deduction comes to an end in March 2023. The super deduction, available from 1 April 2021 to 31 March 2023, allows companies to claim a first-year capital allowance of up to 130% on qualifying expenditures related to plant and machinery.

It's purpose was to encourage investment in these areas as the UK emerged from the pandemic, while also preventing companies from postponing such expenses to a later date when they would be subject to a higher CT rate, albeit usually on a slower reducing balance basis. Additionally, it acted as a link between the announcement and implementation of the 25% CT rate.

With the deadline drawing closer, it's important to consider whether your business could benefit from this successful scheme, and if so, act quickly. If you need any further information or assistance, please feel free to contact our team.